Its not a big holiday - there are no religous or historical overtones, and it was always a little embarassing for me after my son became a man but today , for some reason, without plan or deep thought, I wanted to take a minute to highlight a couple of fathers for their impact on my life.

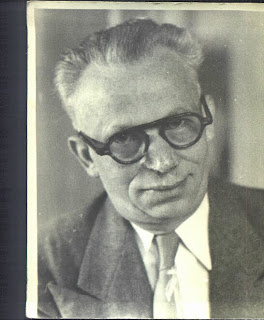

Meet Isadore Lublin, my dad's father who left Russia at the start of the last century to escape the pogroms that victimized his people and his family. He never spoke about his experiences there, but found a new start in this country, where his three sons ( my dad, my Uncle Paul, and my Uncle Harry) grew strong and capable starting businesses and families of their own. He passed away when I was only 7 , but the memories of him persist to this day as a kind and warm man whose family was all important to him.

This is David Krasno, my mother's father. David came to the U.S. as a master watch mechanic in the early 19th century, and after living in New york where he met

his wife, moved to a small town in Pennsylvania where he started a jewelry business, and raised 3 girls, all of whom attended college and became successful in their chosen fields, my Aunt Ruth, my Mom, my Aunt Bette. And all of this at a time when women were not as liberated as they are today. From him I learned that life can be a long and curvy road, but the line to your family should always be a direct one.

This is my father, George Lublin. Born in Philadelphia, he suffered from Polio as a child, though he persevered through and became a physically strong young man after being a sickly child. The oldest of three sons, he left high school during the depression so that he could work and help the family through the tough time. During World War II, physically limited by his encounter with polio, he worked in the Brooklyn Navy Yard, where he built ships and endured antisemitism while his younger brothers went to war .

After the war he began a career as an insurance agent, building a business and a family with my mom, enduring the loss of a child between the births of my sister and myself. And in the midst of life, he endured another blow when in 1961, he was left a widower with an 11 year old son and a 17 year old daughter. He changed careers in the late 1960's to real estate at the urging of his brother Paul, and worked at the same company for the remaining 8 years of his life, until he struggled against lung cancer to the inevitable end.

It is impossible to tell you what I learned from my dad. I don't know if I can attribute my bizarre sense of humor to him, but I'm pretty sure I can attribute my love of books and art to him since I was surrounded by both growing up. I know that I learned a lot about dealing with people and facing adversity from him and he is still the standard for me. I know that he is a presence in my life and that I still miss him even today. I know that while he was a fallible individual as we all are but to me he was a great dad - and I know that he did the best he could with what life gave him to work with.

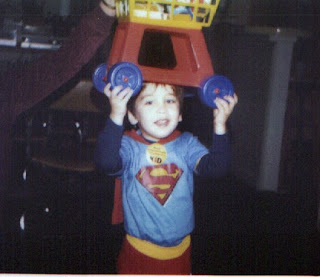

This picture is a pretty special one to me. Its the only picture I own that shows my dad with my son. My son Hal was born on January 9, 1997. My dad George died on August 11, 1977. They had very little time together, and Hal obviously can't remember his grandfather, but my dad knew my son and loved him very much. I still remember taking Hal to the Fox Chase Cancer Center, where my father could join Hal for an impromptu "picnic" on the grass outside his room - a point of happiness in a difficult time.

And of course, here's the reason I get to participate in father's day - my son Hal. No reason for adding this picture here except I really like it. And no son could ever be more super than mine to me :-)

Just a quick jump to a new limb of the family tree - Here is my son's Father-In-Law, Ernest Kelley. (along with Sheila and the lovely Janet Kelley - Hal's Mother-In-Law) . Ernest is a Father who deserves to be mentioned with the guys I'm assembling here. He and Janet are exceptional people who were an absolute bonus to a great daughter-in-law. But in our conversations on many long walks, Ernest has shown me that even though we come from different backgrounds, we meet on the values that make a parent - and a man. (Though I would be remiss if I didn't point out that he ,llike Hal and me married wayyyy over his head!)

And this picture is just one of my favorites. Though I miss my lovely wife, I still have my kids - Hal and Jennifer - and through them the circle of life (thanks Disney) continues - and like every Father everywhere today - they are the greatest gift anyone could ever have. I hope your gifts are just as great!

Existing Home Sales jumped another 6 percent in November, the report's third month of improvement since bottoming in July.

Existing Home Sales jumped another 6 percent in November, the report's third month of improvement since bottoming in July.

Relocate America recently released its 2010 list of

Relocate America recently released its 2010 list of ![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=a280ac98-dd38-420f-a040-4c18052f21d6)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=14422c20-e3ef-49e1-8cbd-dd22c69d0648)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=e311dd6b-c9bf-4e0c-8cde-c98560c11f84)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=02bcb89c-fe15-4fa9-919d-a3ae91ee6e41)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=17b04894-5a29-4d63-8cc7-0264b78d9c1d)

On the first Friday of every month, the U.S. government releases its Non-Farm Payrolls report.

On the first Friday of every month, the U.S. government releases its Non-Farm Payrolls report.![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=146d6be5-8165-4c79-8f4a-0cd549d4481c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=cde7a284-8d45-4114-83ce-60f982ecfb9e)

For the first time this year, Fannie Mae announced significant updates to its mortgage underwriting guidelines.

For the first time this year, Fannie Mae announced significant updates to its mortgage underwriting guidelines.![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=3ef97d6c-5dde-4362-aabf-1f373d3b7f5d)

As a real estate broker whose company's largest concentration is on the existing housing market in Philadelphia and South New Jersey, I only pay a little attentionb to the new housing market. Especially since that market has really been in more of a clean up than expansion mode for the past several years. After all, the existing inventory needs to shrink before we worry about about creating new inventory doesn;t it? It seems that there are indicators that the inventory has been shrinking and that the market has been changing. After a strong March showing and a surprise upward-revision for February, Housing Starts are, once again, trending better.

As a real estate broker whose company's largest concentration is on the existing housing market in Philadelphia and South New Jersey, I only pay a little attentionb to the new housing market. Especially since that market has really been in more of a clean up than expansion mode for the past several years. After all, the existing inventory needs to shrink before we worry about about creating new inventory doesn;t it? It seems that there are indicators that the inventory has been shrinking and that the market has been changing. After a strong March showing and a surprise upward-revision for February, Housing Starts are, once again, trending better.![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d75134b7-ac76-4a60-8911-2f18013947c7)

The Pending Home Sales Index moved higher in March as home sales were spurred by low mortgage rates and an expiring tax credit.

The Pending Home Sales Index moved higher in March as home sales were spurred by low mortgage rates and an expiring tax credit.![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=5f34e4dc-d058-44e2-b413-7449754155f8)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=3877af11-9523-4b95-a5ce-a5d132fee8aa)

Existing Home Sales rose in March, as expected. U.S. home buyers closed on 7 percent more homes as compared to February.

Existing Home Sales rose in March, as expected. U.S. home buyers closed on 7 percent more homes as compared to February.![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=1b9b4c41-1987-46c6-8503-bb839fb3bee7)

Spring is here and Philadelphia homeowners are starting their respective Spring Cleaning rituals.

Spring is here and Philadelphia homeowners are starting their respective Spring Cleaning rituals.![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=83807aee-8255-4952-8b3a-d54674681b34)

Starting Monday, April 5, 2010, getting an FHA mortgage in Philadelphia and throughout the nation will be more expensive for borrowers. Combine that with the short period of time left for the tax credit program and its shaping up to be a busy week for buyers.

Starting Monday, April 5, 2010, getting an FHA mortgage in Philadelphia and throughout the nation will be more expensive for borrowers. Combine that with the short period of time left for the tax credit program and its shaping up to be a busy week for buyers.![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=516d5d6e-3236-4a51-a082-3b2eb343db80)

CNNMoney.com recently published its 2010 forecast and projections for home prices in the country's largest metro markets.

CNNMoney.com recently published its 2010 forecast and projections for home prices in the country's largest metro markets. ![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=229c67fb-6122-42cc-b606-10b59f2ef77d)

Visualizing a home in different colors can take a good eye and strong imagination -- especially when you're house-hunting and the home's effects are of someone else.

Visualizing a home in different colors can take a good eye and strong imagination -- especially when you're house-hunting and the home's effects are of someone else.![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=db9ff71e-037c-4665-ba7f-34c5101dd39e)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=da6b74e9-3aee-4254-8451-2880bf126620)